With the loan comparison platform www.altero.ee, every potential borrower can compare the offers of different lenders and make the most suitable and affordable choice for him. We asked the head of Altero.ee, Taavi Mägi, to name the most common misconceptions about loans based on the experience gained from interacting with the platform’s users.

The purchase or repair of housing, the purchase of a car and other major purchases present the borrower with a difficult choice: where to apply for a loan?

There are many offers on the market and just as many factors that affect the prices of services. In order to make the best choice, you should go through all the banks, fill out a whole stack of papers, collect a huge amount of data…

Many of us are not ready to spend our precious time and therefore choose the first available offer, unfortunately losing thousands of euros.

With the loan comparison platform www.altero.ee, every potential borrower can compare the offers of different lenders and make the most suitable and affordable choice for him. We asked the head of Altero.ee, Taavi Mägi, to name the most common misconceptions about loans based on the experience gained from interacting with the platform’s users.

So, the first misconception: the conditions are always the best in the home bank

Not always! It is true that if you take a loan from a domestic bank, you do not need to submit additional documents or spend time opening an account and other formalities. However, if you turn to another bank, the financial savings can be significant if you take into account both the interest rate and other costs associated with issuing a loan or arranging a lease. The amount of such costs may depend on the borrower’s financial situation, the purpose of the loan, the company’s operating strategy and the financial institution’s service selection.

Another misconception: pensioners and other low-income people cannot take out a small loan or lease a car

Although the interest rates on small loans are higher than on a home loan or car lease, these loans are cheaper than payday loans or credit cards offered by banks. The positive thing is that no collateral is required to get a small loan. Therefore, this loan is a good choice for major purchases or, for example, home repairs.

Third misconception: A small loan is the most expensive type of loan

Ehkki väikelaenude intressimäärad on kõrgemad kui kodulaenul või autoliisingul, on need laenud odavamad kiirlaenudest või pankade pakutavatest krediitkaartidest. Positiivne on see, et väikelaenu saamiseks ei ole vaja tagatist. Seetõttu on see laen hea valik suuremate ostude tegemiseks või näiteks eluaseme remondiks.

Fourth misconception: quick loans should be feared like fire

Quick loans are the most accessible, but at the same time, the loans with the highest interest rate. This loan can be used if a relatively small amount is urgently needed, for example 1000 euros. A quick loan is a suitable option if you know you can pay it back quickly. I recommend avoiding a situation where taking out quick loans or exceeding the credit card limit becomes a habit, and a new quick loan is taken out to repay the quick loan.

Fifth misconception: it is not wise to repay the loan before the deadline

On the contrary – it is reasonable and recommended! The lender calculates the interest until the day the principal amount is fully returned, often without requiring a contractual penalty or future interest payments.

The sixth misconception: To get a small loan, you must have an impeccable credit history

A person who has previously delayed repayments can also get a loan. However, in such a case, the possibility that the loan amount is smaller than recommended and the interest rate is higher must be taken into account, because in the eyes of the lender, it is a customer with a higher risk.

Seventh misconception: You can take out a small loan or formalize a lease only in a bank

Seventh misconception: You can take out a small loan or lease from 60 credit institutions operating in Estonia, which belong to both the banking and non-banking sectors. Before formalizing a loan, we strongly recommend checking whether a specific lender has a license and whether it meets the market standards in force in Estonia. only in the bank

Eighth misconception: Lenders’ offers are quite similar

Offers can differ significantly, even by up to a few thousand euros. The cost of credit is affected by the interest rate set by the lender, the contract fee and other fees, as some lenders charge an extra fee for managing the contract. All aspects must be carefully considered. This is where the loan comparison platform www.altero.ee comes to the rescue.

Misconception 9: The average person cannot understand these details anyway

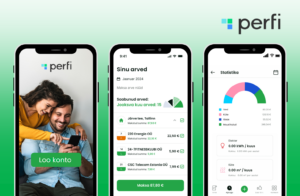

The loan comparison platform Altero.ee does this work for you. Using the platform, you can find the most suitable solution for you conveniently, quickly and for free. The customer only needs to enter the basic data and then within about an hour he will receive an offer from the lenders who present their services on the platform. All that remains for the client is to make his choice and formalize the loan agreement directly with the bank or other credit institution. The contract can be executed digitally.

Misconception ten: You have to pay extra for this service

The service of the loan comparison platform Altero.ee is free – the customer does not pay the platform any additional fees for the transaction.

Altero’s financial comparison platform is a fast-growing start-up company that was founded in Latvia in 2016, started operations in Lithuania in 2019 and in Estonia this spring. Altero’s platform has more than 120,000 customers, and the platform has more than 60 lender partners in the Baltic countries.