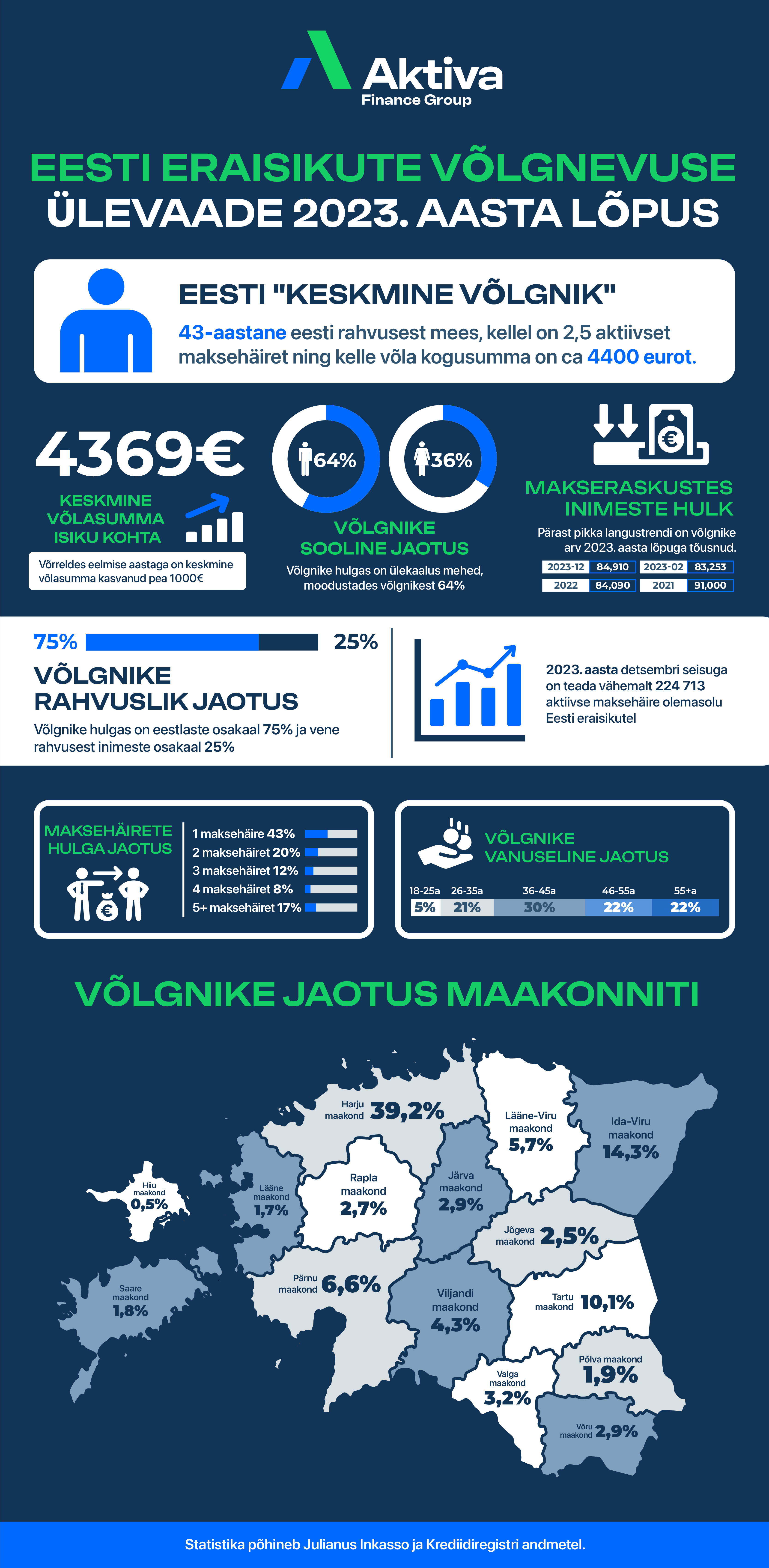

Estonia’s largest financial services infrastructure company, Aktiva Finance Group, compiled a comprehensive overview of Estonians’ debt behavior. Aktiva Finance Group assesses individuals’ creditworthiness and manages overdue credit portfolios through OÜ Krediidiregister and OÜ Julianus Inkasso.

In today’s economically challenging times, we decided to assess the situation in early December, in addition to our regular spring analysis of payment defaults, to get a fresh overview of consumers’ current situation.

Debtor Count Stabilizes, Yet Debt Totals Surge Remarkably

The unique aspect of the ongoing economic crisis is that while its effects are universally felt, no significant rise in defaulters for any creditor exists. The growth in debts is very dispersed. Compared to spring, the number of debtors has only increased by 1500 people. 224,000 active debts need servicing, and their total amount has grown from 280 million to 370 million euros. The average debt amount has risen from 3600 euros to 4400 euros in six months.

Labor Market Depends on Entrepreneurs’ Resilience

Despite layoffs in many Estonian companies, the labor market remains historically high. There are approximately 642,000 people aged 20-64 employed, in addition to about 50,000 pensioners and students. Since the beginning of the year, there has been only a 1% drop in employment.

The critical question is how long entrepreneurs can withstand the current conditions. An economic breakdown could lead to a collapse in the labor market. For example, in 2010, compared to 2008, the number of employed people fell by about 100,000. If such an event were to recur, its impact would be much more devastating than the lockdown during the coronavirus crisis.

Let’s take a closer look at the debt situation in November 2023

| Number of Defaults | Number of Individuals | Percentage | Total Amount | Average Debt per Individual |

| 1 | 37061 | 43,23% | 66 329 262,28 € | 1 789,73 € |

| 2 | 16943 | 19,90% | 68 765 677,80 € | 4 058,65 € |

| 3 | 10346 | 12,17% | 52 092 278,27 € | 5 035,02 € |

| 4 | 6981 | 8,30% | 44 077 865,71 € | 6 313,98 € |

| 5 or more | 13579 | 16,40% | 139 673 155,94 € | 10 292,03 € |

The number of individuals with payment defaults remains relatively the same, with a few percent increase – 83,253 in spring 2023 compared to 84,910 in November 2023.

The average amount has significantly increased even for those debtors with more than three debts, indicating that they have taken on additional loans or their previously contracted loans have become overdue.

More Debt Among Men

Although women constitute a larger share of the Estonian population, men have more payment defaults. The proportion of women in arrears is about half that of men, making up 34% of debtors, while men account for 66%. Yet, the average debt amount for both genders has remained relatively the same.

| Gender | Number of debts | Percentage | Unique persons | Percentage | Summa | Percentage | Average debt by gender |

| man | 143344 | 63,79% | 56315 | 66,32% | 250 400 222,76 € | 63,79% | 4 446,90 € |

| woman | 81369 | 36,21% | 28595 | 33,68% | 120 538 017,23 € | 36,21% | 4 215,65 € |

| Total | 224713 | 100,00% | 84910 | 100,00% | 370 938 239,99 € | 100,00% | 4 369,02 € |

Debt On the Rise Among Working-age Individuals

The number of indebted individuals is increasing fastest among the 18-25 age group but is surprisingly decreasing in the 46+ age group. This indicates less financial responsibility among young people, making them a higher risk for creditors. The debt reduction among those aged 46+ suggests they have incomes or reserves to escape the debt cycle.

| age 18-25 | age 26-35 | age 36-45 | vanus 46-55 | vanus 55+ | |||||||||||

| Amount of debt per person | Number of people | Percentage | Value of debt per person | Number of people | Percentage | Value of debt per person | Number of people | Percentage | Value of debt per person | Number of people | Percentage | Value of debt per person | Number of people | Percentage | Value of debt per person |

| 1 | 2086 | 47% | 1 236 € | 6465 | 35% | 1 6856 € | 9661 | 38% | 1 915 € | 8244 | 43% | 2 233 € | 10605 | 57% | 1 504 € |

| 2 | 885 | 19% | 3 355 € | 3604 | 20% | 3 620 € | 4992 | 20% | 3 553 € | 3952 | 21% | 4 889 € | 3510 | 19% | 4 471 € |

| 3 | 513 | 11% | 4 200 € | 2480 | 14% | 5 329 € | 3285 | 13% | 4 857 € | 2346 | 12% | 5 612 € | 1722 | 9% | 4 414 € |

| 4 | 370 | 8% | 5 667 € | 1735 | 10% | 6 513 € | 2356 | 9% | 6 041 € | 1538 | 8% | 6 775 € | 982 | 5% | 6 139 € |

| 5≥ | 694 | 15% | 8 437 € | 3664 | 21% | 11 168 € | 4708 | 19% | 10 155 € | 2855 | 15% | 10 391 € | 1658 | 9% | 9 351 € |

| Total | 4548 | 100% | 3 442 € | 17948 | 100% | 4 979 € | 25002 | 100% | 4 569 € | 18935 | 100% | 4 805 € | 18477 | 100% | 3 288 € |

Estonians’ Debt Amounts Remain Higher

Russian-speaking Estonian residents comprise 26% of the population but represent a third of all debtors, indicating they are more likely to have payment problems.

On the other hand, Estonians have a higher average debt of 600 euros and more debt per person.

| Nationality | Number of people living in Estonia | Percentage of population | Percentage of debtors | Average value of debt | Average amount of debt |

| Estonian | 925862 | 75,11% | 66,41% | 4 375,65 € | 3,06 |

| Russian | 306801 | 24,89% | 33,59% | 3 710,77 € | 2,81 |

| Total | 1232663 | 100,00% | 100,00% | 4 152,32 € | 2,98 |

Compared to individuals who speak Estonian and Russian as their mother tongue, people who speak other languages have fewer debts and a smaller total debt amount. Often, this is because many of them are foreigners whose permanent residence is not in Estonia. As a result, they have fewer credit agreements and smaller credit limits.

Decrease in Debtors in Ida-Viru County

| County | Amount of people | Share of population | Share of debtors | Share of Total Debt Amount |

| Harju county | 640935 | 46,82% | 39,18% | 41,09% |

| Hiiu county | 9758 | 0,71% | 0,48% | 0,52% |

| Ida-Viru county | 131775 | 9,63% | 14,30% | 10,72% |

| Jõgeva county | 27902 | 2,04% | 2,51% | 2,52% |

| Järva county | 29818 | 2,18% | 2,89% | 3,07% |

| Lääne county | 20827 | 1,52% | 1,65% | 2,81% |

| Lääne-Viru county | 58792 | 4,29% | 5,71% | 5,67% |

| Põlva county | 24369 | 1,78% | 1,89% | 1,63% |

| Pärnu county | 87765 | 6,41% | 6,60% | 7,16% |

| Rapla county | 33976 | 2,48% | 2,65% | 2,67% |

| Saare maakond | 34549 | 2,52% | 1,75% | 1,84% |

| Tartu county | 159932 | 11,68% | 10,07% | 10,07% |

| Valga county | 27926 | 2,04% | 3,16% | 2,91% |

| Viljandi county | 45587 | 3,33% | 4,28% | 4,43% |

| Võru county | 35006 | 2,56% | 2,88% | 2,89% |

| Total | 1368917 | 100,00% | 100,00% | 100,00% |

The geographical distribution of debtors across Estonian counties has largely remained the same.

Despite the difficulties businesses currently face, the labor market has remained surprisingly strong. However, it’s almost certain that lenders’ losses will increase due to the rising average debt amount, amplified by high interest rates increasing the discount rates of debt amounts.

Take a look at the infographic in Estonian.