The finance ecosystem, developed by our team at Aktiva Finance Group, includes a range of business entities. Collectively, we facilitate the best choices for transaction partners, customer verification (KYC), bill payment and transmission, as well as collection services and debt portfolio management. Our Marketing Director, Raili Somelar, offers insights into the nuances of our finance ecosystem through the lens of an individual client’s financial etiquette.

No matter what your role is with money, in one way or another, it’s always connected to the companies or individuals around you. Financial relationships place us in a connection with the surrounding economic environment, and our planning skills help us navigate through challenging times.

“If I will not pay my bill today, nothing happens” Think again.

For some reason, we’ve become accustomed to thinking that everything we do, we do for ourselves. In the financial world, it can be the opposite; what we neglect might affect others. If we could all think that my financial decisions, obligations, and discipline are calculated within a system and are part of the proper functioning of the economy, the overall picture would be much more beautiful. A simplified example: I own a monthly sports club membership with a fee of 50 euros. If I leave it unpaid, it might seem that nothing fatal happens. However, if another 1000 people think similarly, it adds up to 50,000 euros, and that’s no longer a small amount. It affects the sports club, leading to things not being done, such as investments, repairs, salary payments.

However, on the other hand, these also reflect people’s inability to plan cash flows, take excessive risks, or not utilizing necessary financial wisdom platforms. According to Krediidiregister OÜ, in 2023, at least one payment default is registered for 83,253

individuals. Compared to 2020, when at least 101,000 people were facing payment difficulties, this number is consistently decreasing. The trend continues that the number of people facing payment difficulties has been slightly decreasing in recent years. However, the average debt amount of debtors is continuously increasing. Given the overall price increase, this can be easily explained as well.

You should systematize costs and draw conclusions

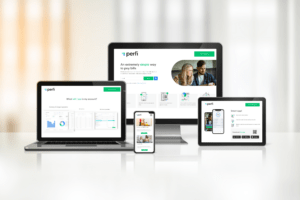

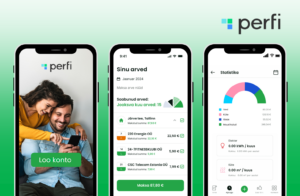

While 30% of Lithuanians use the Perfi platform to pay everyday bills (electricity, rent, utility bills, hobby groups, etc.), among Estonians, this still requires adaptation. A significant number of Estonians prefer to use bank direct debits, but fewer people use analysis to systematize costs and draw conclusions. Just having the ability to link all my bank accounts into a neutral environment, make payments with a single click, receive reminders, categorize, and then save them to the archive based on these systems provides additional support for financial wisdom.

Julianus Inkasso OÜ registered nearly 40,000 claims during the first half of 2023, with an average amount slightly exceeding 500 euros. Meanwhile, the proportion of parking-related claims in the portfolio has increased, impacting the size of the average claim. Certainly, the inability of individuals to plan their cash flows, excessive risk-taking, or, for example, the lack of utilization of necessary financial literacy platforms, plays a significant role here.

On October 05 and 06, as part of the Impact Day at the Põhjala factory, a novel payment management platform called Perfi will be presented. You can already get acquainted with it on the website.